Deciding on your retirement savings strategy can be difficult. You can use numerous tools and tactics; you can reverse them if you make a mistake.

This is why you should know the difference between Roth conversions vs. recharacterizations to make informed choices about your IRAs. When comparing recharacterization vs. Roth conversion, you must consider your tax situation, financial circumstances, and overall retirement goals.

What is the difference between a Recharacterization vs a Roth Conversion?

A Roth conversion involves moving tax-deferred funds from a retirement plan to a Roth IRA. You are transferring funds from a tax-deferred retirement account to a Roth IRA. These tax-deferred accounts include a traditional IRA, simple IRA, and SEP IRA.

You pay taxes upfront but enjoy tax-free withdrawals with a Roth IRA. With this strategy, you can make conversions directly or indirectly.

A recharacterization is something different. You can change the designation of your IRA from a Roth IRA to a traditional IRA or vice versa. This switch can serve as an undo button if you change your mind about a conversion. You should keep in mind that recharacterizations are reversible for up to one year.

Recharacterizations of traditional or Roth IRAs allow you to easily reverse a conversion from a Roth IRA to a traditional IRA. You can also use a recharacterization to switch the type of IRA after making a contribution. If you contribute to a Roth IRA and change your mind, you can recharacterize your contribution to a traditional IRA.

You can pursue recharacterizations for different reasons, including changes in tax situation or a decrease in the value of the converted investment. During a recharacterization, the original account receives the converted or contributed amount, as if the conversion or contribution never happened. This also includes any associated gains or losses.

For example, let’s say you made contributions to a traditional IRA, assuming your income exceeded the threshold for Roth contributions. If your income is lower than expected, consider using a Roth IRA. A recharacterization would allow you to treat the initial contribution as a Roth IRA contribution.

You might wonder about the difference between a Roth recharacterization vs a conversion. Since the Tax Cuts and Jobs Act of 2017, Roth IRA conversions are not reversible. This means you can’t recharacterize a Roth conversion, but you can still recharacterize Roth IRA contributions.

How Does Recharacterization Work?

When comparing Roth IRA conversions vs recharacterizations, consider the complexity of the process. Direct conversions are simple — all you need to do is instruct your IRA trustee.

For an indirect conversion, you make a withdrawal and directly submit it to your IRA. You have a 60-day window to redeposit the funds into the IRA of your choice. However, conversions have a taxable impact and penalty fees.

On the other hand, a recharacterization will require much more paperwork and tax documentation.

First, inform your IRA custodian that you intend to recharacterize your IRA. They are responsible for guiding you through the necessary procedures specific to their institution. They will instruct you to submit a recharacterization request.

You must clearly state your request's exact amount and original contribution date. Your IRA custodian is responsible for transferring funds between different types of IRAs. Again, this includes all associated earnings or losses from the recharacterized contribution or conversion.

Your IRA custodian will report the recharacterization using IRS Form 5498. If you make recharacterizations on contributions to an IRA, you will need two Form 5498s to file your tax return. You will use one for the contribution and the other for the recharacterization. You must complete recharacterizations by the due date, including extensions, for your tax return for the year of the original contribution.

You will also receive a Form 1099-R for the IRA that first receives the contribution. This is a form you use specifically to report distributions made from retirement accounts. Since the transaction is a recharacterization, it is not taxable. Before 2017, you might have considered a Roth IRA recharacterization vs a conversion because these transactions are not taxable.

How to Calculate Your IRA Recharacterization

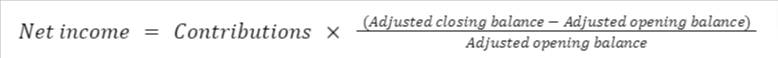

Before you recharacterize an IRA contribution, you may want to calculate your earnings and losses. The IRS has a simple formula to help you calculate this:

You need to keep in mind that the computation period starts immediately before you make the contribution to your IRA. This period ends immediately when you make the recharacterization. Your IRA will use a fair market value to determine gains and losses if you don't have a daily evaluation.

Errors in tax reporting for a recharacterization can put you in trouble with the IRS when you file your tax return. You should work with tax professionals to understand the impact of your decisions and ensure accurate calculations.

Alternatives to a Recharacterization

A recharacterization is merely a tool the IRS offers to help you reverse conversions or change the designation of IRA contributions. However, you don’t have to pursue a recharacterization if you don’t need to. You should always make financial decisions based on your needs, especially when comparing a backdoor Roth conversion vs a recharacterization.

Backdoor Roth conversions can be an alternative to making recharacterizations later on. With a backdoor Roth conversion, you make contributions to a traditional IRA and later convert it to a Roth IRA. High-net-worth individuals typically do this because they are not eligible to make direct Roth IRA contributions.

You should consult a financial planner with tax experience before attempting a backdoor Roth conversion. There are many factors to consider, like the pro-rata rule and potentially putting yourself in a higher tax bracket. With bad timing, conversions to a Roth IRA can leave you with a hefty tax bill.

Use the Best Financial Strategy for Your Needs

You have complex financial needs, and it’s crucial to seek guidance from knowledgeable tax advisors and financial planners. You need experts who can provide up-to-date information and help you navigate the intricacies of your individual financial situation.

At Asset Preservation Wealth and Tax, our professionals can assess your financial circumstances so you can plan ahead. As fiduciaries, it’s our responsibility to ensure you have the best guidance to maximize your financial well-being.

Get a free portfolio review today!

A Roth conversion may not be suitable for your situation. The primary goal in converting retirement assets into a Roth IRA is to reduce the future tax liability on the distributions you take in retirement, or on the distributions of your beneficiaries. The information provided is to help you determine whether or not a Roth IRA conversion may be appropriate for your particular circumstances. Please review your retirement savings, tax, and legacy planning strategies with your legal/tax advisor to be sure a Roth IRA conversion fits into your planning strategies.

Stewart Willis is the founder and president of Asset Preservation Wealth & Tax, a financial planning firm in Phoenix, Arizona. Investment advisory services offered through Foundations Investment Advisors, LLC, an SEC registered investment adviser.

The commentary on this blog reflects the personal opinions, viewpoints and analyses of the author, Stewart Willis, providing such comments, and should not be regarded as a description of advisory services provided by Foundations Investment Advisors, LLC (“Foundations”), an SEC registered investment adviser or performance returns of any Foundations client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment, legal or tax advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Foundations for services, execution of required documentation, including receipt of required disclosures. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Foundations manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Any statistical data or information obtained from or prepared by third party sources that Foundations deems reliable but in no way does Foundations guarantee the accuracy or completeness. Investments in securities involve the risk of loss. Any past performance is no guarantee of future results. Advisory services are only offered to clients or prospective clients where Foundations and its advisors are properly licensed or exempted. For more information, please go to https://adviserinfo.sec.gov and search by our firm name or by our CRD # 175083.

.jpg)